Managed Futures

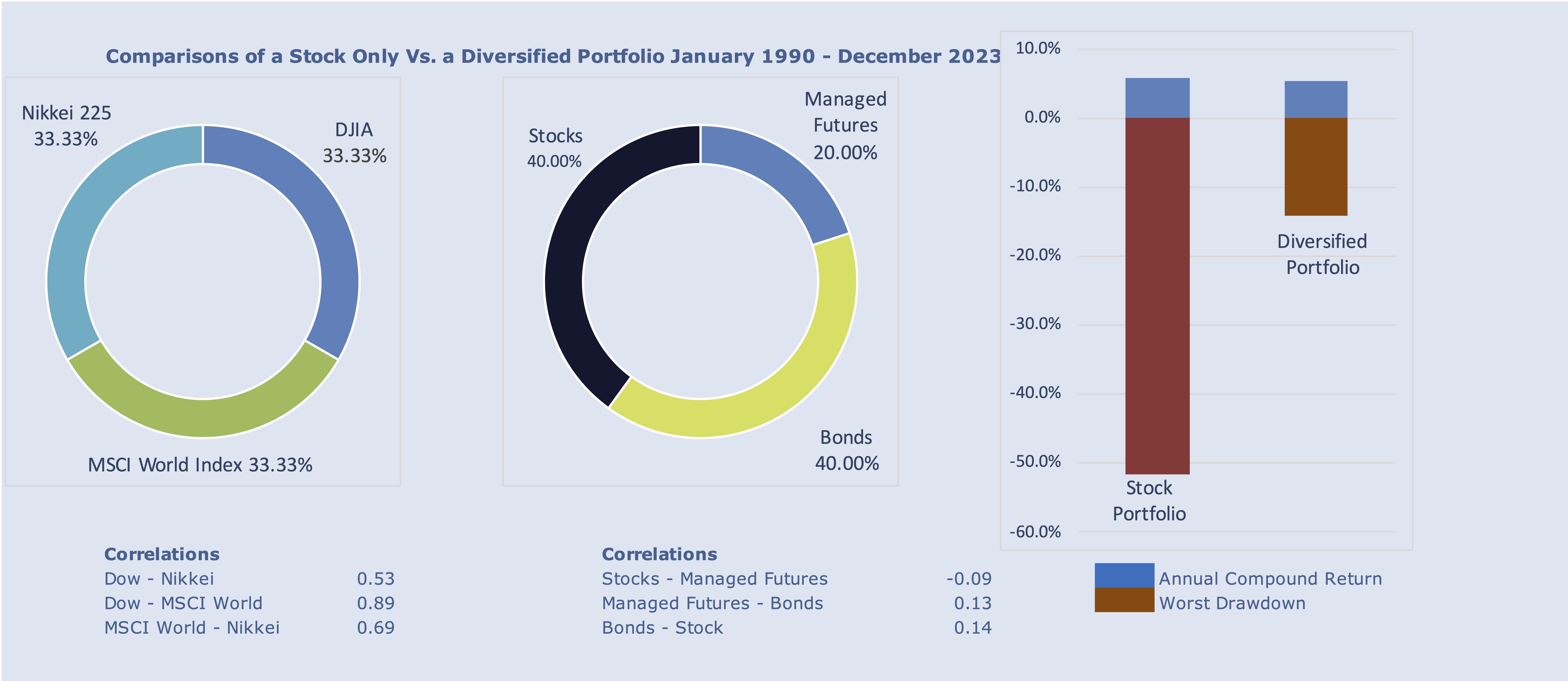

By their very nature, managed futures provide a diversified investment opportunity. Trading advisors can participate in more than 150 global markets; from grains and gold to currencies and stock indices. Many funds further diversify by using several trading advisors with different trading approaches. In this example below, the overall risk (as measured by maximum drawdowns) is reduced from -63.6% to -35.9% and the return increases from 6.51% to 19.78%. This is mainly due to the lack of correlation and, in some cases, negative correlation between come of the portfolio components in the diversified portfolio. There is even negative correlation between stocks and managed futures in this example, as the two markets move independently from each other. The potential benefits of managed futures within a well-balanced portfolio include:

|

|

This material mentions services provided by the Barclay CTA Index. Please note that the data is derived from only those CTAs who submit their trading results. The index in no way purports to be representative of the entire universe of Commodity Trading Advisors. The material in no way implies that these results are officially sanctioned results of the commodity industry. Be advised that an individual cannot invest in the index itself and the actual rates of return for an individual program may significantly differ and be more volatile than the index. Trading futures and options involves substantial risk of loss and is not suitable for all investors. There is no guarantee of profit no matter who is managing your money. Past performance is not necessarily indicative of future results. Hypothetical Examples of a Combined Managed Futures & Stock Portfolio

The following hypothetical examples should prove quite helpful in better understanding how a relatively small investment in managed futures can increase overall portfolio performance: Let’s assume your total portfolio is $250,000 and you invest 80% in stocks and bonds ($200,000) and 20% in managed futures ($50,000). Let’s assume at the end of the year you realize a 5% return on your stocks and bonds and a 25% return on managed futures. The result would be as follows:

| $250,000 Portfolio | Percentage of Portfolio | Return |

| Stocks & Bonds: $200,000 | 80% | 5% Profit: $10,000 |

| Managed Futures: $50,000 | 20% | 25% Profit: $12,500 |

| Total Profit: $22,500 |

Now let’s assume you earn 10% on the 80% of your portfolio invested in stocks and bonds, but lose 25% in managed futures. The results would be as follows:

| $250,000 Portfolio | Percentage of Portfolio | Return |

| Stocks & Bonds: $200,000 | 80% | 10% Profit: $20,000 |

| Managed Futures: $50,000 | 20% | 25% Loss: ($12,500) |

| Total Profit: $7,500 |

Conclusion You can see, in these hypothetical examples, by investing only 20% of your portfolio in futures, if you were to earn 25%, it would outperform 80% of your portfolio invested in stocks and bonds if the stocks and bonds earned 5%. You can also see that a 25% loss in futures would still leave you with a net profit of $7,500 if your stock and bond allocation returned 10%. Note: No matter what the size of your portfolio, 80% invested in stocks and bonds and 20% invested in managed futures, with the same percentage returns, would produce the same percentage results in our hypothetical examples. Important Disclaimer: The above hypothetical examples are strictly for illustration purposes only, to help you better understand the potential impact of portfolio diversification. In no way are the examples to be construed as the returns you might receive in stocks and commodities. Of course, in actual investing, your results can be better or worse. Futures traders should be aware that daily market volatility might cause loss despite prevailing trends in the stock market. The risks associated with trading futures and options are significantly different than those of stock investing and investors may lose more than their initial investment. While we advocate diversification, please be advised that it will not necessarily provide protection against substantial loss. Past performance is not necessarily indicative of future results. |

Register to Receive More Info |

Michael A. DeRose - President / CEO